Author

Author  Correspondence author

Correspondence author

Bioscience Methods, 2016, Vol. 7, No. 2 doi: 10.5376/bm.2016.07.0002

Received: 28 Mar., 2016 Accepted: 16 Jul., 2016 Published: 30 Nov., 2016

Obasoro A.S., Obisesan O.O., and Onabajo O.J., 2016, Rice farmers’ willingness to pay for agricultural insurance in Ogun state, Nigeria, Bioscience Methods, 7(2): 1-11

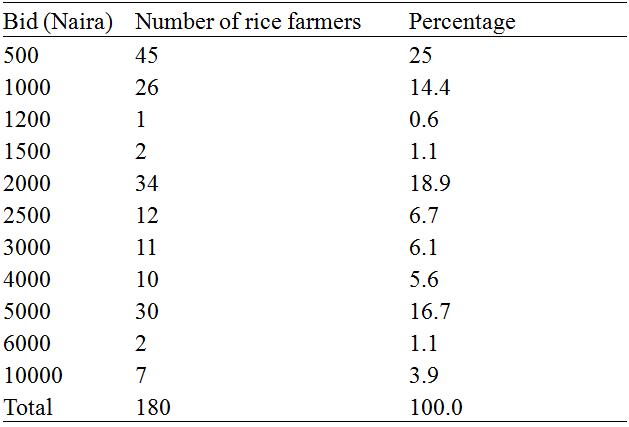

This study was carried in order to determine the willingness of rice farmers to take agricultural insurance in Ogun State. Total of 180 questionnaires were administered and data were collected on socioeconomic characteristics, major risks encountered by farmers, extent of awareness about agricultural insurance, premium farmers are willing to pay for insurance etc. Descriptive statistics, contingent-valuation and logistic regression were used for data analysis. Descriptive analysis showed that (65.6%) of the respondents were male, (43.9%) had agriculture as their major occupation, (58.9%) were 31-50 years, average household size was 6, farm size was ±1.25 hectares and mean monthly income was ₦23,461. Major risks encountered by rice farmers in the area are pest and diseases, drought, inadequate technology and poor storage system. 28.3% of the respondents were aware of agricultural insurance but did not subscribe for it. Estimates from the logistic regression revealed that household size, education, primary-occupation, farm size, source of information and membership of association played significant role on farmers’ awareness of agricultural insurance (significant at 1, 5 and 10 percent). The mean amount farmers were willing to pay as premium was ₦2,412.05 while farmers involved in the cultivation of improved rice varieties (ITA 150/WAB 189) were willing to pay more premium (₦5,753.92) compared to their counterparts (₦1,590.69) involved in the local varieties (Ofada/OS6). Gender, primary-occupation, farm size, income, premium charged and awareness level significantly influences willingness to take agricultural insurance by these rice farmers.

1 Introduction

Rice production in Nigeria is predominantly in the hands of small scale farmers, contributing more than 60% to agricultural output in Nigeria (Wambara, 2014). Many small scale rice farmers are not assisted and as such unable to rise beyond the level of subsistence to high level productive capacities (Enjorals et al., 2012). The biggest challenge among rice farmers is the loss of their crop to floods, drought as a result of limited irrigation facilities or inadequate water supply, pest infestation and other unattractive conditions thereby reducing their expected income (Wambura, 2014). At the end of the cropping season, rice farmers are expected to cater for the needs of their nuclear and extended families, acquire new inputs, get ready for the challenges of the next cropping seasons as well as repay loans, failure of which might cause them to lose their productive assets like land and other valuables used as collateral (Wasim et al., 2013).

Although agricultural insurance exists in Nigeria, Eleri et al. (2012) revealed that less than 1% of Nigerian rice farmers actually take agricultural insurance. Thus, many of these rice farmers are put out of business immediately they suffer any form of disaster due to lack of insurance cover. Agriculture has been perceived to be synonymous with risk and uncertainty (Eleri et al., 2012) and the enterprise is still perceived as the most risky in Nigeria (Wasim et al., 2013). Moreover, the Nigerian Agricultural Insurance corporation (NAIC, 2014) report showed that only 5% of Nigerian farmers access agricultural insurance, which has been blamed on the cold attitude of farmers to insurance practice(s), lack of awareness and enlightenment of farmers and level of penetration of agricultural insurance which is still very low in the country.

Agricultural insurance policy is one of the notable methods by which farmers can share or transfer the risks and uncertainties associated with their farming enterprise. it encourages them to make greater investment in agricultural production, promotes their confidence in venturing into adoption of new and improved farming practices, enhances their accessibility to credit by financial institutions as the insurance cover can serve as an added collateral and a form of indemnity which ensures continuity of their farming enterprise (Farayola et al., 2013). Although insurance schemes exist in Nigeria, it covers less than 1% of the total population of farmers (Eleri et al., 2012). In this study an estimation of the willingness of rice farmers to take insurance was put to the fore considering the importance of rice production to the Nigerian economy and the inherent risks involved.

This study therefore aims to estimate the willingness to pay for agricultural insurance among small-scale rice farmers in Ogun State, specifically, the study identify major risks encountered by the rice farmers in the study area, give a description of farmers awareness to agricultural insurance and examined factors influencing the awareness status of rice farmers to agricultural insurance.

2 Literature Review

2.1 The concept of agricultural insurance

According to Sundar and Ramakrishnan (2013), insurance is a contract made for financial arrangement between two parties when few suffered losses are met from the funds accumulated through small contributions made by many who are exposed to similar risks. Nwosu et al. (2010) defined agricultural insurance as the stabilization of income, employment, price and supplies of agricultural products by means of regular and deliberate savings and accumulation of funds in small instalments by many in favourable time periods to defend some or few of the participants in bad time periods.

2.2 Models of agricultural insurance

Indemnity-based are products determined to claim payment based on the actual loss incurred by the policy holder. If an insured event occurs, an assessment of the loss and a determination of the indemnity are made at the level of the insured party (Yusuf, 2010).

Index-Based Insurance these products pay out claims based on an Index measurement and not on losses measured in the field. The index is a variable that is highly correlated with losses and that cannot be influenced by the insured. Indices can include rainfall, temperature, regional yield or river levels (Iturrioz, 2009)

Crop Revenue Insurance protects insured parties from the consequences of low yields, low prices or a combination of both. It provides significant benefits to producers that rely on short term crop financing which is repaid from agricultural revenues and financiers who have extended the crop finance. It gives both the producer and the financier certainty that revenues estimates on which loans are based will largely be realized (Iturrioz, 2009).

Property Insurance can be viewed as an indirect form of agricultural insurance as it is not taken on the actual crop but rather on the farm assets used in production. This form of insurance is taken by farmers to protect their farm property against theft and fire. This may be taken on tractors, trucks and any other farm equipment (Sureh et al., 2011)

Willingness to Pay (WTP) approach is a form of monetary valuation that indicates the minimum value that an individual will place on the quality of his or her environment. In other words, the values represent how much people are prepared to spend in preventing damage either to the environment or to them (Hill et al., 2013; World, 2013).

3 Methodology

3.1 Study area

The research was conducted in Ikenne Agricultural Zone of Ogun State. It comprises of four local government areas including Obafemi Owode, Ikenne, Sagamu and Remo North Local Government area. Ogun State (one of the major rice producing states in South Western Nigeria) was created in 1976 and lies within 6 degree north and 8 degree north and longitude 2 degree east and 5 degree east and is bounded in the west by the republic of Benin, in the east by Ondo State, in the north by Oyo State and in the south by Lagos State and the Atlantic Ocean. Ogun State consists mainly of the Yoruba Ethnic group which includes the Egbas, Egbados, Aworis, Eguns, Ijebus and Ijebu-remos. The people are predominantly farmers who engage in various agricultural activities, while the non-farming population engage in petty trading and small-scale business activities (Onakomaiya et al., 2000).

3.2 Source of data

This study employed primary data collected with the aid of structured questionnaire, administered during a farm-level survey carried out on upland rice farmers in the Ikenne Agricultural Zone of Ogun State. Information was gathered on socio economic characteristics of the rice farmers (such as age, marital status, sex, family size, educational status, farming experience), major risks encountered by the farmers, extent of farmers’ awareness to agricultural insurance, premium farmers are willing to pay in order to access agricultural insurance, etc. Open ended questions were also used to obtain the willingness to pay (WTP).

3.3 Sampling Technique and Sample Size

A multi stage sampling procedure was used Ikenne Agricultural Zone of Ogun State (this comprises of Obafemi Owode, Ikenne, Sagamu and Remo North Local Government area) was purposively selected because the area houses the largest farming population in Ogun State and is generally known as the largest producer of a local upland rice variety – OS6, Ofada rice (Ogun state Agricultural Development Programme (Ogadep, 2011). From the four communities, 45 respondents were randomly selected. A total of 180 questionnaires were administered on the rice farmers.

3.4 Estimation of Mean Willingness to Pay

3.4.1 The Logistic Regression Model

Where: i = 1, 2, 3, ...n

Xi is a set of independent variables;

Y is an independent variable;

βo is the intercept which is constant;

βi is the coefficient of the price that the small-scale rice farmers are willing to pay in a bid to take agricultural insurance

Pi is a probability function, which is the farmers’ response to their awareness about agricultural insurance.

WTIi is the willingness to take insurance.

Xi is a vector of observed characteristics of an individual. They include socio -economic and attitudinal attributes of the rice farmers. The equation is expressed implicitly as:

Awareness = F(X1, X2, X3, X4, X5, X6, X7, X8, εi)

Where:

WTI = Awareness about agricultural insurance (1 if yes, 0 if otherwise)

X1 = Gender (1=male, 0=female)

X2 = Age of household head (years)

X3 = Marital Status (1= single, 2=married, 3= others)

X4 = Education (0=no formal education, 1=primary, 2=secondary, 3=tertiary)

X5 = Primary Occupation (1=farmers, 2= civil service, 3= trading, 4= artisan, 5= retiree)

X6 = Monthly income (₦)

X7 = Farming experience of rice farmer (1= ≤10 years, 2= 11-20, 3= 31-40, 4=41-50 years)

X8 = Farm size (1=2-<4, 2= 4-<6, 3= ≥ 6)

X9 = Contact with extension agents (0=no, 1=yes)

X10 = Source of information (0= none, 1= fellow farmers, 2= banks, 3= mass media)

X11 = Membership of association (1= belong, 0= otherwise)

β1, β2...β11 are parameters corresponding to estimated variables’ coefficients.

εi is the error term and consists of unobservable random variables.

Logitic regression was used to accomplish the model estimation because of its ability in dealing with discrete dependent variables, it adjust better and has the advantage of the utility function remaining linear with parameters used (Cameron 1998; Olojede and Adeoye 2014).

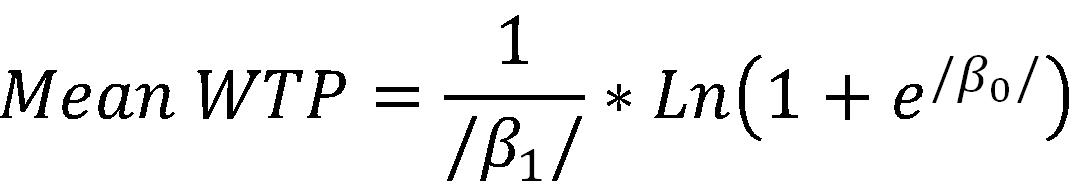

3.4.2 The contingent-valuation (CV)

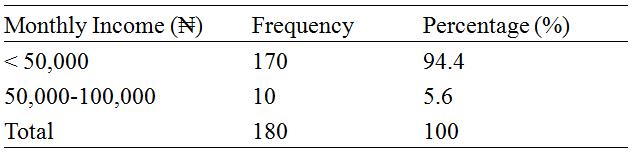

his method entails the use of a questionnaire survey to obtain data on the preferences and characteristics of the rice farmers (Cameron and James, 1989; Cameron and Quiggin, 1994). The survey allows for the direct elicitation of monetary payments by asking respondents their willingness to pay (WTP) for agricultural insurance (Tables 1-3). Adopting Donovan and Nicholls (2003), the mean willingness to pay for agricultural insurance is expressed as:

Where β0 and β1 are absolute coefficient estimates from the logistic regression and the mean WTP is the mean for the agricultural insurance by rice farmers.

|

Table 1 Respondents’ Distribution of Prices Willing to take Agricultural Insurance |

|

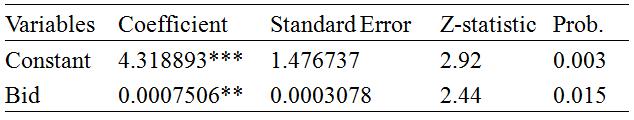

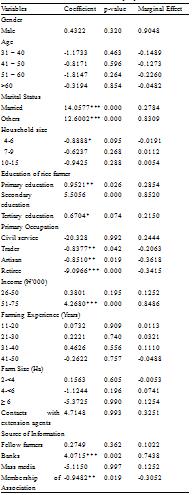

Table 2 Regression results and mean willingness to pay

Note: **indicates statistical significance at 1%; Degree of freedom = 1; Log likelihood = -46.6782; Pseudo R2 = 0.5228; Chi2 (LR Statistics) = 102.24; Significance Level = 0.0000; Mean WTP = ₦2,412.05

|

|

Table 3 Regression results and mean willingness to pay among local rice farmers

Note: ***indicates statistical significance at 1%; Degree of freedom = 1 ; Log likelihood = -20.519448; Pseudo R2 = 0.5228; Chi2 (LR Statistics) =0.7069; Significance Level = 0.0000; Mean WTP = ₦1590.69

|

4 Results and Discussion

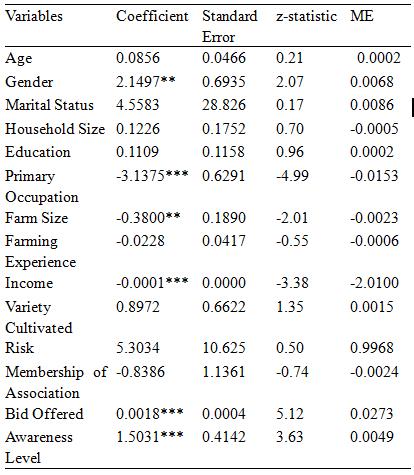

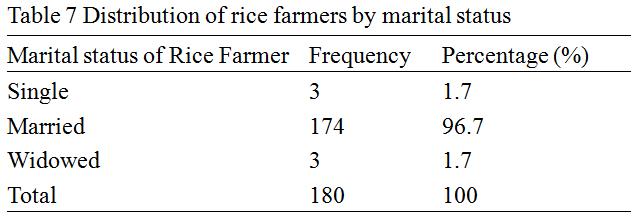

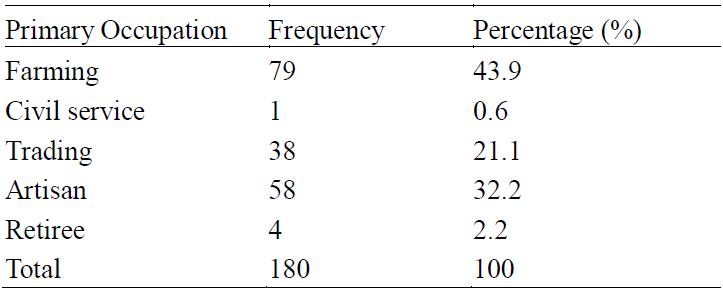

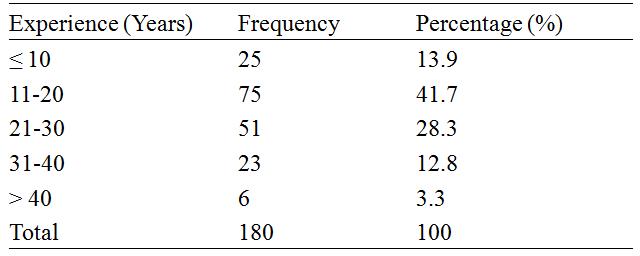

The descriptive analysis (Tables 4-12) shows that majority of the respondents (65.6%) were male, most of them (43.9%) stated that agriculture was their major occupation. More than half of the rice farmers (58.9%) fall within the age bracket of 31-50 years with an average household size of 6 members cultivating an average farm size of 1.25 hectares. In all, 63.3%, 18.3%, 2.8% and 15.6% of the respondents have no formal education, primary, secondary and tertiary education respectively. However, 70 percent of the farmers have been in rice farming for between eleven and thirty years which is relatively long enough for them to have gained mastery of the enterprise. The mean monthly income was ₦23,461.

|

Table 4 Distribution of rice farmers by gender |

|

Table 5 Distribution of rice farmers by age |

The coefficient of gender was found to be positive and significant at 10 percent. This result reveals that male farmers were more willing to take agricultural insurance in the study area with a marginal effect of 0.67% compared to their female counterparts. With respect to the primary occupation of the rice farmers, it was observed that not only was it significant at 1 percent but it was also having a negative influence on the willingness of the rice farmers to take agricultural insurance. Willingness to take agricultural insurance (Table 13) is constrained by the size of farm land possessed by the rice farmer. The negative influence it exerts on the willingness of the rice farmer to take agricultural insurance is significant at 10 percent. This result suggests that with every unit increase in the farm size, the farmers are 0.23% less likely to take agricultural insurance. This could mean that the farmers are contented with the attendant increase in income occasioned by an increased farm land which is however contrary to the findings of Farayola et al. (2013), where farm size was shown to have a positive influence on the participation of farmers in agricultural insurance scheme.

|

Table 13 Regression results and mean willingness to pay among improved rice farmers

Note: **indicates statistical significance at 1%; Degree of freedom = 1; Log likelihood = -18.092449; Pseudo R2 = 0.3426; Chi2 (LR Statistics) = 18.86; Significance Level = 0.0003; Mean WTP = ₦5753.92

|

Income is significant but negative with a coefficient of -0.0001 which is rather negligible (Table 14). This is contrary to the findings of Wambura (2014) who showed that income of farmers had a positive influence on their willingness to adopt crop insurance. However, according to Babalola (2013), income factor includes the level of income from the farm and off-farm activities. With regards to the bid offered, it was observed to be significant at 1 per cent. The result reveals that the marginal effect on probability of rice farmers taking agricultural insurance with respect to bid offered is 0.0273 (Table 15). This implies that for every ₦1 increase in the bid offered, the likelihood of taking agricultural insurance increases by 0.0273, contrary to the findings of Babcock and Hart (2005) and Sheik et al.(2005) who carried out a study on crop insurance uptake and failure of United States (U.S) agriculture and agreed that there is an inverse relationship between costs of insurance premium and adoption of insurance cover. Rice farmers are interested in agricultural insurance and are willing to take it is made available and easily accessible to them. Awareness (Table 16) was significant at 1 percent having a positive influence on the willingness to take agricultural insurance. The result reveals that the marginal effect on probability of rice farmers taking agricultural insurance with respect to awareness is 0.0049, implying that for every unit increase in the awareness among the farmers, the likelihood of taking agricultural insurance increases by 0.0049 in line with the findings of Babalola (2014) that as the level of awareness of the farmers about insurance increase, the probability of adoption also increases.

|

Table 14 Log it Regression of Factors Influencing Willingness to Take Agricultural Insurance by Rice Farmers

Note: Coefficients marked***, **,* are significant at level of 1%, 5% and 10% respectively; LR Chi2 (13) = 147.56; Log likelihood= -24.0083; Pseudo-R2= 0.7545; Prob> chi2 = 0.0000

|

5 Summary, Conclusion and Recommendation

5.1 Summary of major findings

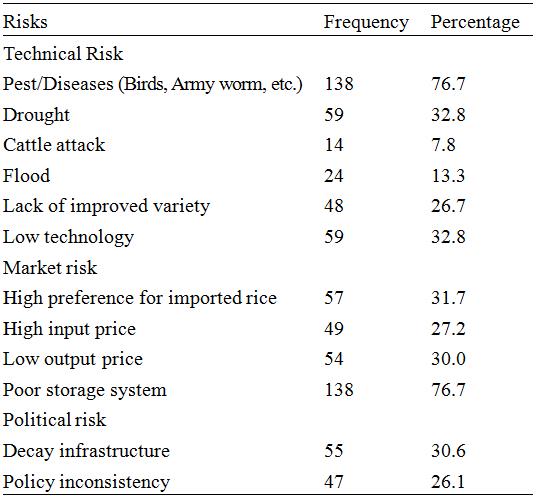

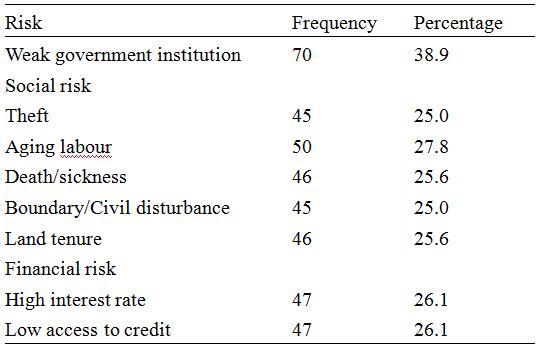

The major risks encountered by rice farmers include pest and diseases, drought, low technology, poor storage system and weak government institutions (Table 17a; 17b). 28.3% of the respondents were aware of agricultural insurance but majority of them did not subscribed (Table 18). The subscribed rice farmers did so along with agricultural credit loan. The estimates of the logistic regression model revealed that household size, education level, primary occupation, farm size, source of information and membership of association of the farmers were significant influence to farmers’ awareness about agricultural insurance (Table 14). Household size was significant at 10% with a negative influence on awareness of the existence of agricultural insurance. Also, education and primary occupation were also significant at 5% with negative and positive influences on awareness respectively. The farm size, source of information and membership of association were significant at 10%, 1% and 5% with negative, positive and negative influences on awareness respectively. The mean willingness to pay was ₦2,412.05 also revealed that the farmers were willing to take agricultural insurance generally. However, farmer involved in the cultivation of improved rice varieties (ITA 150/WAB 189) were willing to pay more on the average (₦5753.92) compared to their counterparts (₦1590.69) involved in the local varieties (Ofada/OS6). The result shows that some of the factors (gender, primary occupation, farm size, income, the premium charged and awareness level) were significantly influencing willingness to take agricultural insurance by the rice farmers.

|

Table 17a Distribution of Rice Farmers According to Sources of Risk |

|

Table 17b Distribution of Rice Farmers According to Sources of Risk Note: *Multiple responses were recorded |

5.2 Conclusion

Rice farmers in the study area are willing to take agricultural insurance since they are still within the active working years of their lives. Those involved in the cultivation of improved rice varieties were willing to pay more in order to take agricultural insurance. The study also revealed that despite the array of risks the farmers are exposed to in their production activities most of the farmers are not aware of the existence of agricultural insurance (Table 11). While the respondents that were aware of agricultural insurance did not subscribe to it. Participation in social and community-based organizations like farmers association, self-help groups and cooperative credit societies increased the probability of being aware. It has been found to be an important tool of increasing the awareness about agricultural insurance among the rice farmers.

5.3 Recommendations

Insurance stakeholders can promote awareness on agricultural insurance among rice farmers through advertisements of agricultural insurance cover or through use of extension services. This is also expected to enhance loan payment ability among rice farmers. Insurance protection can also enable farmers to access credit easily from other sources which they can use to expand their investment in agriculture. More farmers should be educated on the importance of agricultural insurance through rigorous marketing of agricultural insurance program by the insurers or through the efforts of agricultural extension workers. In order to make premium more affordable to many rice farmers and encourage adoption of agricultural insurance in rice farming, the government should enhance the process of premium subsidization.

Babalola D.A., 2014, Determinants of Farmers’ Adoption of Agricultural Insurance: the Case of Poultry Farmers in Abeokuta Metropolis of Ogun State, Nigeria. British Journal of Poultry Sciences 3 (2): 36-41

Babalola D.A., and Babalola Y., 2013, Economic effects of media campaign against pandemic diseases: The Case of Bird Flu (H5N1) on poultry business in Ogun state, Nigeria. Arabian Journal of Business and Management Review, 2(12): 80-88

https://doi.org/10.12816/0002364

Babcock B.A., and Hart C.E., 2005, Influence of Premium Subsidy of Farmer’s Crop Insurance Coverage Decision. Working paper OS-WP 393, Centre for Agricultural and Rural Development, Iowa state University, Ames

Bateman I.J., Carson R.T., Hanemann M., Hanley N., Hett T., Lee M.J., Loomes G., Mourato S., Ozdemiroglu E., Pearce D.W., Sugden R., and Swanson J., 2002, Economic Valuation with Stated Preference Techniques. Edward Elgar, Massachusetts

https://doi.org/10.4337/9781781009727

Bateman I.J., Langford I.H., Jones A.P. and Kerr G.N. 2001, Bound and path effects in double and triple bounded dichotomous choice contingent valuation. Resource and Energy Economics 23(3): 191-213

https://doi.org/10.1016/S0928-7655(00)00044-0

Cameron T.A., 1988, A new paradigm for valuing non-market goods using referendum data: Maximum likelihood estimation by censored logistic regression. Journal of Environmental Economics and Management 15(3): 355-379

https://doi.org/10.1016/0095-0696(88)90008-3

Cameron T.A., and James M.D., 1987, Efficient Estimation Methods for Closed-Ended Contingent Valuation Surveys. Review of Economics and Statistics 69(2): 269-276

https://doi.org/10.2307/1927234

Cameron T.A., and Quiggin J., 1994, Estimation Using Contingent Valuation Data From a Dichotomous Choice With Follow-up Questionnaire. Journal of Environmental Economics and Management 27(3): 218-234

https://doi.org/10.1006/jeem.1994.1035

Donovan G. H., and Nicholls D.L., 2003, Estimating consumer willingness to pay a price premium for Alaska secondary wood products. Research Paper PNW-RP-553. Portland, OR: United States Department of Agriculture, Forest Service, Pacific Northwest Research Station. 7p

Eleri O.E., Uduka I.K., Akuto N., Onuvae P., Anwara O., 2012, Towards a Climate-based Agricultural Insurance Reform in Nigeria. Presented at the Workshop on Legal and Regulatory Frameworks for Agricultural Insurance Reform in Nigeria – Protecting Nigeria’s Farmers from Climate Change Kano Hall, Transcorp Hilton Hotel, February 27, pp.1–53

Enjolras G.F., Capitanio and Adinolfi F., 2012, The Demand for Crop Insurance. Combined Approaches for France and Italy. Agri. Eco. Rev., 13(1):5-22.

Farayola C.O., Adedeji I.A., Popoola P.O., and Amao S.A., 2013, Determinants of Participation of Small Scale Commercial Poultry Farmers in Agricultural Insurance Scheme in Kwara State, Nigeria. World Journal of Agricultural Research, 1(5): 96-100

Fonta W.M, Ichoku H.E., Ogunjiuba K.K., 2008, Using a Contingent Valuation Approach for Improved Solid Waste Management Facility: Evidence from Enugu State, Nigeria. Journal of African Economies, 17(2): 277-304

https://doi.org/10.1093/jae/ejm020

Hill R.V, Hoddinott J., and Kumar N., 2013, Adoption of weather-index insurance: learning from willingness to pay among a panel of households in rural Ethiopia. Agricultural Economics; 44(4-5): 385-398

https://doi.org/10.1111/agec.12023

Iturrioz R., 2009, Agricultural Insurance. World Bank, Washington D.C Iturrioz, R. 2009, Agricultural Insurance. Primer Series on Insurance, Issue 12, Nov 2009, The World Bank

Kjaer T., 2005, A review of the discrete choice experiment with emphasis on its application in health care. Health Economics, University of Southern Denmark Nigerian Agricultural Corporation, 2007, NAIC Annual bulletin, 1-52

Nwosu F.O., Oguoma N.O., Lemchi J.I., Ben–Chendo G., Henri-Ukoha A., Onyeagocha S., and Ibeawuchi I., 2010, Output Performance Of Food-Crop Farmers Under The Nigerian Agricultural Insurance Scheme In Imo State, South East, Nigeria, Academia Arena, 2(6)

Onakomaiya O., Odugbemi O.O., and Ademiluyi I.A., 2000, Savings Mobilization among rural farming households in Anambra State of Nigeria. Quarterly Journal of International Agriculture, 31(3): 301-309

Sheik S., Coble K.H., and Knight T.O., 2005, Revenue Crop Insurance Demand. Paper Presented at AAEA Annual meetings, providence, Rhodes Island, 24-27

Sundar J. and Lalitha R., 2013, A Study on Farmers’ Awareness, Perception and Willingness to Join and Pay for Crop Insurance. International Journal of Business and Management Invention; pp.48-54

Suresh-Kumar D., 2011, An Analysis of Farmers’ Perception and Awareness towards Crop Insurance as a Tool for Risk Management in Tamil Nadu, Agricultural Economics Research Review, 24: 37-46

Wambura S.R. 2014, Analysis of Benefits and Factors Influencing Crop Insurance Adoption in Tobacco Farming in KuriaMigori County. University of Nairobi; College of Agriculture and Veterinary Sciences, 1-34

Wasimul R., Nabila A. and Hafeezur R., 2013, Intellectual Capital Efficiency and Financial Performance of Insurance Sector in Pakistan: a Panel Data Analysis, Middle-East Journal of Scientific Research, 17 (9): 1251-1259,

World B., 2013, World Development Indicators/Global Development Finance database (Washington, DC: The World Bank); as posted on the World Bank website: http://data.worldbank.org/data-catalog/ (downloaded on August 19, 2014)

Yusuf K.K., 2010, Insurance Options in Risk Management in Agriculture Finance. Being the full text of paper presented on the occasion of the AFRACA Conference in Abuja

. PDF(440KB)

. FPDF(win)

. HTML

. Online fPDF

Associated material

. Readers' comments

Other articles by authors

. O.A. Obasoro

. O.O. Obisesan

. O.J. Onabajo

Related articles

. Willingness to pay

. contingent-valuation

. logistic regression

. agricultural insurance

. Ogun state

Tools

. Email to a friend

. Post a comment

.png)

.png)

.png)

.png)

.png)

.png)

.png)